AT ITS 11TH AGM, FBNHOLDINGS REASSURES SHAREHOLDERS OF SUSTAINED IMPROVEMENTS AND DIVIDENDS

By People’s Voice Nigeria | News

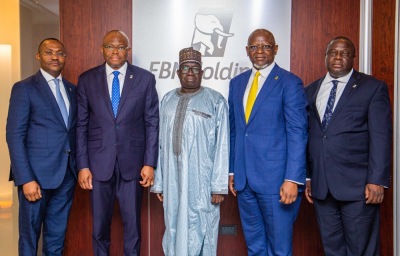

The 11th Annual General Meeting (AGM) of FBN Holdings Plc (FBNHoldings), the parent company of Nigeria’s premier financial inclusion services provider, FirstBank, was held on Tuesday, 15 August 2023.

The virtual AGM was presided over by Alhaji Ahmad Abdullahi, the Group Chairman with shareholders, directors, Management staff and other stakeholders in attendance.

Alhaji Ahmad Abdullahi presented an overview of the group’s performance over the past financial year highlighting key achievements, strategic initiatives and vastly improved performance indices. The Chairman outlined the strategic plans for the upcoming year and informed shareholders of appointments to the board.

The Group Chairman reiterated the group and its subsidiaries’ commitment to continuously innovate and leverageopportunities to build on its customer-centric services, as he underscored the value of these services in achieving sustainable growth and impact on the host communities of its businesses across the globe.

Among the key highlights of the AGM were the strong financial performance despite the challenges experienced in the global business climate. The group sustained improvement on key indicators as its gross earnings and net interest income recorded growth, with NPL reducing from 6.1% to 4.3%, demonstrating its prudent risk management.

The Group’s technology adoption and digital transformation of its businesses were also discussed as it reiterated the commitment to leverage cutting-edge technology which remains at the heart of its approaches.

On dividend, the group announced dividend of 50kobo per share to its shareholders which is an increase of 43% from 35kobo per share paid in prior year.

There were also new appointments to the board. The group announced the appointment of Femi Otedola and Oyewale Ariyibi into the board as Non-Executive Director and Executive Director, respectively.

The resolution to increase the Company’s Issued Share Capital from 17,947,646,396 of 35,895,292,792 ordinary shares of 50kobo each to N22,434,577,995 by the creation and addition of up to 8,973,823,198 ordinary shares of 50kobo was also approved at the meeting. The amendment of clause 6 of the Memorandum of Association, to reflect the newly issued capital of N22,434,557,995 by the creation and addition of up to 8,973, 823, 198 ordinary shares of 50K was also approved.

Speaking further at the AGM, Alhaji Ahmad Abdullahi, the Group Chairman of FBNHoldings said “the Group actively develops targeted initiatives to strengthen its capacity to create value greater than the sum of the individual parts. At FBNHoldings, technology and innovation are at the core of what we do. We recognise the competitive advantage innovation affords us and ensure it takes the front seat in the design, development and enhancement of our products and services.”

“Acknowledging the vital role our employees play in creating shareholder value, we consistently leverage best-in-class training and development programmes for upskilling and reskilling members of staff to enhance professional competence, drive innovation and boost overall corporate agility. Our people, across the cadres, have stayed true to our Core Values – Entrepreneurial, Professionalism, Innovative and Customer-Centricity (EPIC) – and have shown commitment to the Group’s strategic aspirations.”

The 11th AGM of the financial services group reflected the sustained growth trajectory in its financial performance as the group reiterated its resolve to boost shareholders’ value andpositively impact businesses and lives of its host communities.

About FBNHoldings

FBN Holdings Plc is a leading African banking and financial services group serving individuals, businesses, organisations and governments in leading markets across the continent and globally. FBNHoldings’ principal subsidiary is First Bank of Nigeria Limited (FirstBank), Nigeria’s foremost financial institution and leading banking services provider. FirstBank has forged an incredible partnership with its people and built an enduring heritage through a vast array of seasons and societies, to remain an icon delivering to the Gold Standard in today’s financial services industry in Africa and beyond.

FirstBank with operations in 10 countries and subsidiaries that include FirstBank (UK) Limited, FirstBank in the Democratic Republic of Congo, Ghana, The Gambia, Guinea, Sierra-Leone and Senegal, and First Pension Custodian Limited.

Other entities within the parent FBN Holdings are the Merchant Banking and Asset Management businesses, which comprise FBNQuest Merchant Bank Limited, FBNQuest Capital Limited, FBNQuest Securities Limited, FBNQuest Asset Management Limited, FBNQuest Trustees Limited and FBNQuest Funds Limited.

In the Insurance business, FBN Insurance Brokers Limited is a wholly owned subsidiary of FBN Holdings Plc, with its Headquarters in Lagos and branches in Abuja, Port Harcourt, and Ibadan leveraging on FirstBank’s over 700 branches and its network of subsidiaries in servicing its clients.