Ecobank Group Declares N156.55bn PAT in FY2022 Results; Proposes 0.11cents Final Dividend,(SP:N10.55k)

By People’s Voice Nigeria | News

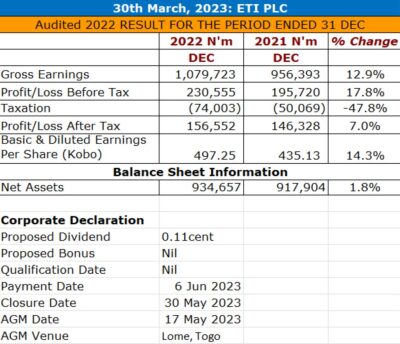

ETI Plc, a financial institution in financial services sector announced 12.9% gross earnings growth in FY 2022 Audited Results.

Key Highlights

Hello Gross Earnings grew by 12.9% from N956.39bn to N1,079,723bn. Profit before tax stood at N230.55bn

Profit after tax stood at N156.55bn

Share Price Currently Stands at N10.55k

Proposes Final Dividend of 0.11cents

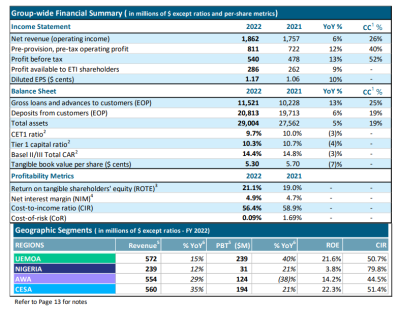

Ecobank Group reports audited full year 2022 Profit Before Tax of $540m on Net Revenues of $1.9bn

Diversification benefits, underlying growth momentum, and efficiency gains drove PBT growth.

Record ROTE of 21.1%, TBVPS of 5.30 US cents and diluted EPS of 1.17 US cents.

Proposed dividend of $28m or 0.11 US cents ($0.0011) per share subject to shareholder approval at AGM.

Jeremy Awori, CEO of Ecobank Group, said: “Ecobank’s strong 2022 performance reflects the strength of our diversified business model, growth momentum and efficiency, and was achieved despite operating in a challenging macroeconomic environment, which also included the difficulties that Ghana’s debt restructuring exercise placed on us.

“We grew profit before tax by 13% to $540 million, translating into earnings per share growth of 10% and delivering a record return on shareholders’ equity of 21.1%. With stubborn inflationary pressures in 2022, improving our cost-to-income ratio to 56.4% demonstrates our discipline around cost management. Moreover, we further reduced the amount of non-performing loans to 5.2%, reflecting our continued progress in improving credit quality. Our balance sheet is well capitalised, with a total capital adequacy ratio of 14.4% above the regulatory minimum.”

Awori added: “I started as Group CEO on March 1 st, and I would like to thank Ade Ayeyemi, my predecessor, the Board, and all Ecobankers for their invaluable contribution to the Group’s performance. Ecobank is a unique and important pan-African franchise with substantial competitive advantages. It is still early days, so I can only offer my preliminary thoughts. We are working on creating a strategic roadmap that will drive growth, transformation and returns. In addition to our core corporate and investment banking business, we are seeing exciting opportunities for accelerating growth in our payments, consumer and commercial businesses as these represent fast-growing revenue pools in many of our markets.”

“Our focus will be on execution, and we will have a performance, sales and service culture to drive success. Success for us will mean winning with the customer. So, we will reinvigorate our customers’ experience with Ecobank through investments in building a solid and enduring brand that offers them a more personal, relevant and rewarding experience than ever before. This will also deliver further solid financial performance for the Bank.”

Awori concluded: “I thank Ecobankers across the Group for working hard and smart to meet our customers’ needs. I am excited to work purposefully with and for our customers, partners, Board, shareholders and regulators to build an Ecobank for which we can all be proud.”

Financial and Business Highlights:

• Profit before tax of $540m, up 13% or 52% at constant currency. The PBT growth was supported by the benefits of our diversified business model, the underlying growth momentum in our businesses and disciplined management of costs and credit losses in a challenging operating environment. In the Group’s business units, solid profit growth in Commercial Banking, up 100% to $134m and Consumer Banking, up 50% to $130m, was partially offset by a decrease of 17% to $333m in Corporate and Investment Banking PBT, mainly due to impairment charges associated with Government of Ghana’s (GoG) debt restructuring exercise.

• Profit available to ETI shareholders increased by $24m, or 9% to $286m, which translated into a diluted earnings per share (EPS) of 1.17 US cents, an increase of 10%, and record return on tangible shareholders’ equity (ROTE) of 21.1%.

• Net revenue rose 6% or 26% at constant currency to $1.9bn, reflecting diversification benefits, growth momentum, and efficiency gains, which led to solid growth in net interest income and noninterest revenue.

• Payment’s revenues grew $25m or 12% to $234m (representing 13% of Group net revenues), driven by merchant acquiring, cards, and wholesale payments.

• Record cost-to-income ratio of 56.4% benefited from solid revenue growth and disciplined cost management in an inflationary environment.

• Total assets increased $1.4bn to $29.0bn, primarily driven by growth in loans and investment securities catalysed by customer deposits growth.

• Customer deposits (end-of-period, EOP) increased 6% or 19% at constant currency to $20.8bn.

• Gross customer loans (EOP) increased 13% or 25% at constant currency to $11.5bn.

• The non-performing loans (NPL) ratio improved to 5.2% (the lowest since the 3Q of 2015) compared to 6.2% a year ago. The NPL coverage ratio decreased to 86.5% from 102.1% a year ago, respectively, mainly due to the $126m central macro-overlay ECL release.

• Tangible book value per share (TBVPS) of 5.30 US cents decreased 7% from a year ago, primarily reflecting the negative impact of foreign currency translation reserves.

• The volume of digital transactions rose by 26% to $79.7 billion in 2022

• Record cost-to-income ratio of 56.4% benefited from solid revenue growth and disciplined cost management in an inflationary environment.

• Total assets increased $1.4bn to $29.0bn, primarily driven by growth in loans and investment securities catalysed by customer deposits growth.

• Customer deposits (end-of-period, EOP) increased 6% or 19% at constant currency to $20.8bn.

• Gross customer loans (EOP) increased 13% or 25% at constant currency to $11.5bn.

• The non-performing loans (NPL) ratio improved to 5.2% (the lowest since the 3Q of 2015) compared to 6.2% a year ago. The NPL coverage ratio decreased to 86.5% from 102.1% a year ago, respectively, mainly due to the $126m central macro-overlay ECL release.

• Tangible book value per share (TBVPS) of 5.30 US cents decreased 7% from a year ago, primarily reflecting the negative impact of foreign currency translation reserves.

• The volume of digital transactions rose by 26% to $79.7 billion in 2022